[ad_1]

South Korean experts have predicted that the crypto market’s capitalization will rise from around $800 billion to some $1.5 trillion next year. And they claim that “stabilizing” inflation figures “during the first half of next year” will whet investors’ appetites for Bitcoin (BTC) and other tokens.

The claims were made in a study named “2023 Cryptoasset Market Prospect Report” by the research wing of the South Korean crypto exchange Korbit and reported by Edaily.

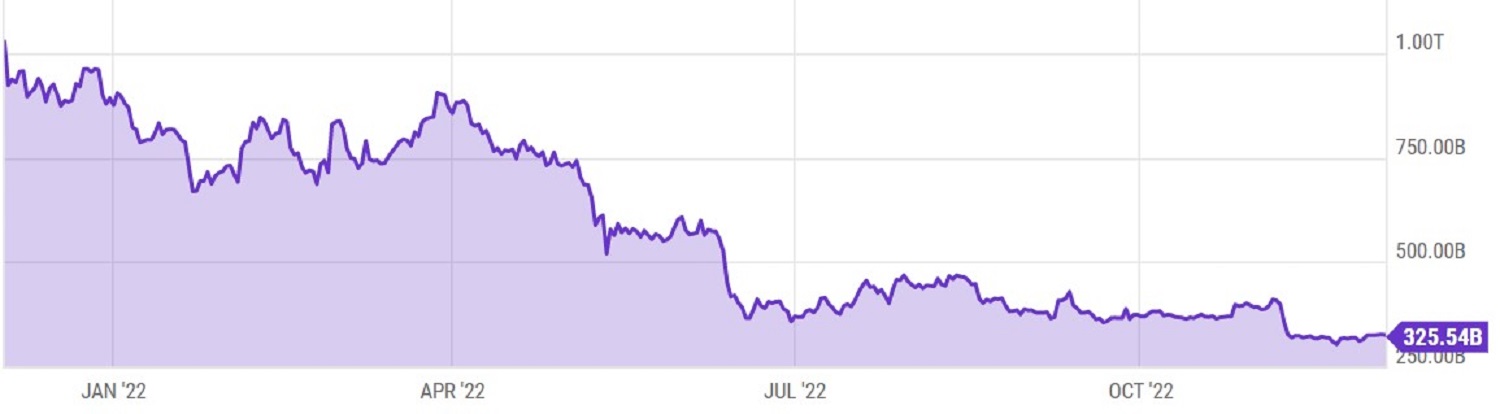

The bitcoin market cap is currently down over 65% from a year ago, but some appear hopeful of a recovery.

The Korbit researchers claimed that while central banks like the United States’ Federal Reserve have “strengthened risk asset avoidance,” there are signs that the Fed will back away from 2022 policies next year – sparking a “recovery” in the “demand for higher-risk assets” such as crypto.

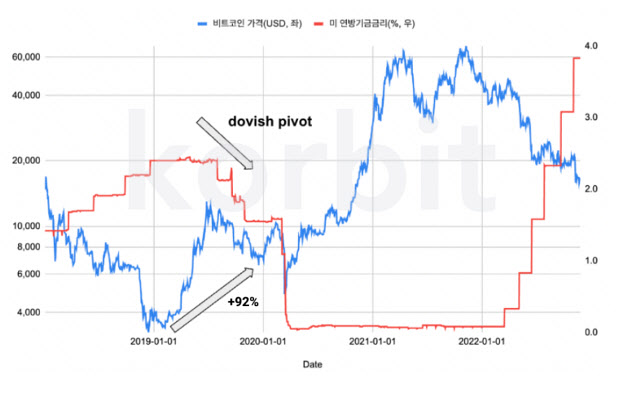

The researchers added that they expected 2023 “to be similar to 2019” – a period when crypto began to make a gradual recovery following the icy crypto winter of 2018.

One of the leading researchers in the study stated:

“The public often thinks that the 2018 crypto crash continued in 2019. But in fact, the bitcoin price recovery in 2019 reached 92%.”

The Korbit researchers stated that Fed policies in early 2019 saw the central bank halt a series of interest rate hikes. This led to a “dovish pivot” in bitcoin prices in September of the same year. A similar event is likely to take place next year – provided the Fed does indeed refrain from raising interest rates.

The researchers also made the following predictions for 2023:

- Adoption will rise – and mainstream firms will begin looking at not only BTC options, but also Ethereum (ETH) adoption proposals

- The synergy between stablecoins, the DeFi sector, and traditional financial institutions will increase

- Tether (USDT), USD Coin (USDC), and BUSD will “fiercely compete for supremacy” as stablecoins race to become “the next dollar”

Possible “market volatility” inducing events next year include the following:

- New regulations introduced globally in the wake of the FTX collapse

- Fresh concerns over centralized exchanges, again due to the fall of FTX and the fallout

- The verdict of the legal struggle between the US Securities and Exchange Commission and Ripple

- the success or failure of American progressive crypto regulation spearheaded by the likes of Wyoming Senator Cynthia Lummis

[ad_2]

cryptonews.com