[ad_1]

Dunamu, the operator of Upbit, South Korea’s biggest crypto exchange, has denied it is poised to buy a securities company – and says it is instead eyeing non-fungible token (NFT) expansion.

The operator has recently been linked with a takeover move for an unnamed domestic securities provider. But Sisa Week reported Dunamu has “denied” the “rumor” has any truth and called the claims “unfounded.”

Dunamu said:

“We have not discussed the acquisition of a securities company.”

With tokenized securities set to be given the regulatory green light in the near future, a number of South Korean players are hoping to enter the market.

But the company said that it was “expecting to focus on strengthening” its NFT-related “business.”

The company last year created a US-based joint venture firm named Levels – with Hive, the an entertainment company behind the chart-topping K-pop boyband BTS.

Dunamu has also announced plans to expand its digital collectibles offering via Levels-related business operations.

The exchange has cornered between 60% and 80% of the domestic crypto market, per South Korean media outlets. But after meteoric growth in 2021, the market slowdown has hit all domestic exchanges.

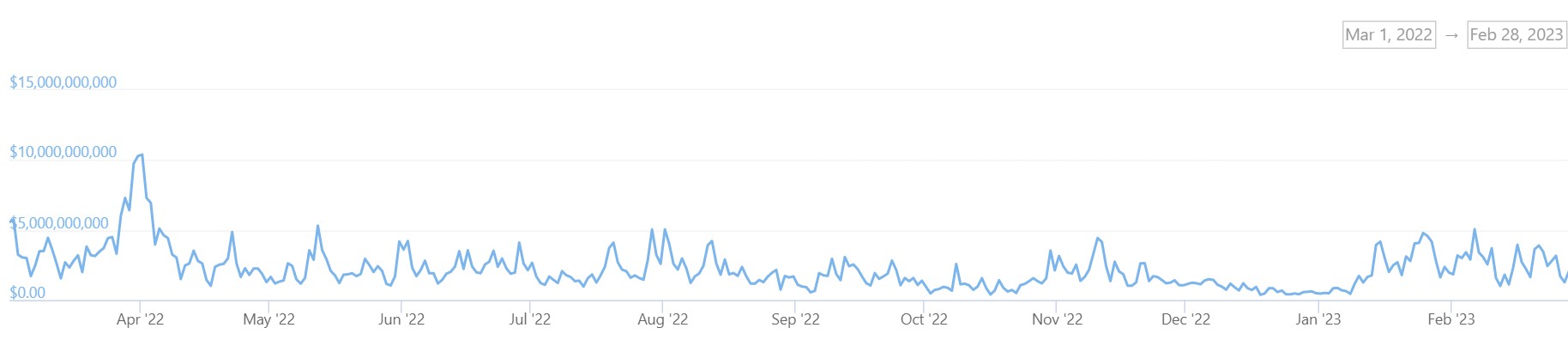

While daily trading volumes on Upbit peaked at over $10.5 billion in April 2022, that figure fell down to just over $400 million in late December. Trading volumes are now fluctuating around the $1-2 billion range.

As such, the media outlet explained, industry officials are expecting Dunamu to announce its annual performance for 2022 – with grim readings expected.

Upbit: No Securities Takeover Plans, NFT Expansion Targeted

The media outlet noted that Dunamu’s earnings “plummeted” in the third quarter of FY2022, meaning that annual earnings would also shrink.

While the firm does have other business avenues, few of these are currently profitable – and Sisa Week noted that 99% of the firm’s revenue “comes from its trading platform.”

The firm was hotly tipped to launch on the New York Stock Exchange in 2021, but talk on this front appears to have cooled since the onset of crypto winter.

[ad_2]

cryptonews.com