[ad_1]

Bitcoin, the world’s most valuable cryptocurrency, has been rising and has reached $23,333 for the first time since August 19. Over the weekend, BTC broke through the $23,000 barrier for the first time in five months, making it exciting for the cryptocurrency market.

Meanwhile, Ethereum, the second-largest digital coin, reached $1,664.78 for the first time since November 7, 2022.

The reason for its bullish trend, on the other hand, could be attributed to institutional investors, who are increasing their holdings in anticipation of the next bull run.

The price of bitcoin (BTC) has recently increased, benefiting both short-term and long-term investors, according to on-chain statistics.

It is also worth noting that the percentage of Bitcoin holders who are now profiting in the short term has risen to 97.5%, the highest level since November. Long-term BTC holders, on the other hand, have benefited from Bitcoin.

Aside from that, investors ignored the numerous issues confronting the cryptocurrency industry, most recently Genesis Global Holdco LLC’s petition for Chapter 11 bankruptcy protection. As a result, the BTC gains were unaffected.

Risk-On Crypto Mood Pushes Bitcoin and Ethereum To New Highs

The global cryptocurrency market has maintained its upward trend and is currently flashing green near the $1.06 trillion mark. This came after bitcoin, the world’s most valuable cryptocurrency, broke through the $23,000 barrier for the first time in five months, indicating that the cryptocurrency market is entering a new era.

However, institutional investors, who are increasing their holdings in anticipation of the next bull run, are the primary drivers of rising BTC demand.

Bitcoin, the world’s largest digital asset, is in an unusually upbeat mood after rising by more than 36% this month. Moving on, the next major turning point in the cryptocurrency market could occur at the upcoming Fed meeting next month.

How The Bearish US Dollar Is Underpinning Bitcoin’s Price Rally

The falling value of the US dollar is another factor supporting the price of the cryptocurrency. On Tuesday, the broad-based US dollar remained on the defensive, sitting at a nine-month low against the euro and giving back recent gains against the yen as traders continued to assess the likelihood of a US recession and the direction of Federal Reserve policy.

The US dollar index, which compares the greenback to a basket of six rival currencies such as the euro and yen, fell 0.09% to 101.92, closing in on the 7-1/2-month low of 101.51 set on Wednesday.

BTC Bulls: Short-Term And Long-Term Holders Are Winning Big Time

The price of bitcoin (BTC) has risen significantly in recent weeks, generating profits for both short- and long-term investors, according to on-chain statistics.

At the time of writing, the percentage of Bitcoin holders making short-term profits had risen to 97.5%, the highest level since November.

Long-term Bitcoin holders, according to Glassnode, have also benefited from Bitcoin.

Gemini Downsizes To Adapt To The New Economic Reality

A spokeswoman for Gemini, a cryptocurrency exchange, told CNBC on Monday that the company will lay off nearly 10% of its total workforce. In less than a year, Gemini has seen at least three rounds of layoffs.

According to PitchBook data, Gemini had 1,000 employees as of November 2022, which means that 100 people may have lost their jobs.

According to TechCrunch, Gemini previously reduced its workforce by 7% in July 2022, following a 10% reduction the previous month.

As a result, while this may be considered negative news, it has had no negative impact on the cryptocurrency market thus far.

On the other hand, the growing number of COVID-19 cases in China will have an impact on the cryptocurrency market. As a result, this was regarded as a critical factor that could limit future gains in the cryptocurrency’s price.

Bitcoin Price

Bitcoin is currently valued at $23,097 and has a $27 billion 24-hour trading volume. Bitcoin has gained over 1% in the last 24 hours. With a live market worth of $435 billion, CoinMarketCap presently ranks top.

Bitcoin is currently facing heavy resistance around a $23,250 level along with an immediate support at $22,500. If the candles fall below the $22,500 level, a bearish correction will most certainly commence and last until the $21,500 mark is hit. If Bitcoin falls below $21,500, it might fall as low as $20,450.

The RSI and MACD indicators are overbought, but the recent bullish engulfing candle is signaling chances of a bullish trend continuation. On the upside, the immediate resistance level for Bitcoin is $23,250, and a break above this level might expose BTC to levels as high as $23,900 and $25,150.

Buy BTC Now

Ethereum Price

The price of Ethereum in the last 24 hours was $1,635, with a trading volume of $8.3 billion. The ETH/USD pair has found immediate support at $1,610, and candles closing above this level are likely to trigger an increase in BTC.

On the upside, ETH is anticipated to face immediate resistance at $1,675, and a bullish crossover over this level might expose ETH to $1,750.

On the downside, a bearish breakdown of $1,610 might open up additional selling space till $1,550.

Buy ETH Now

Bitcoin Alternatives

CryptoNews Industry Talk has reviewed the top 15 cryptocurrencies for 2023. If you’re looking for a higher potential investment opportunity, there are plenty of other projects worth considering.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

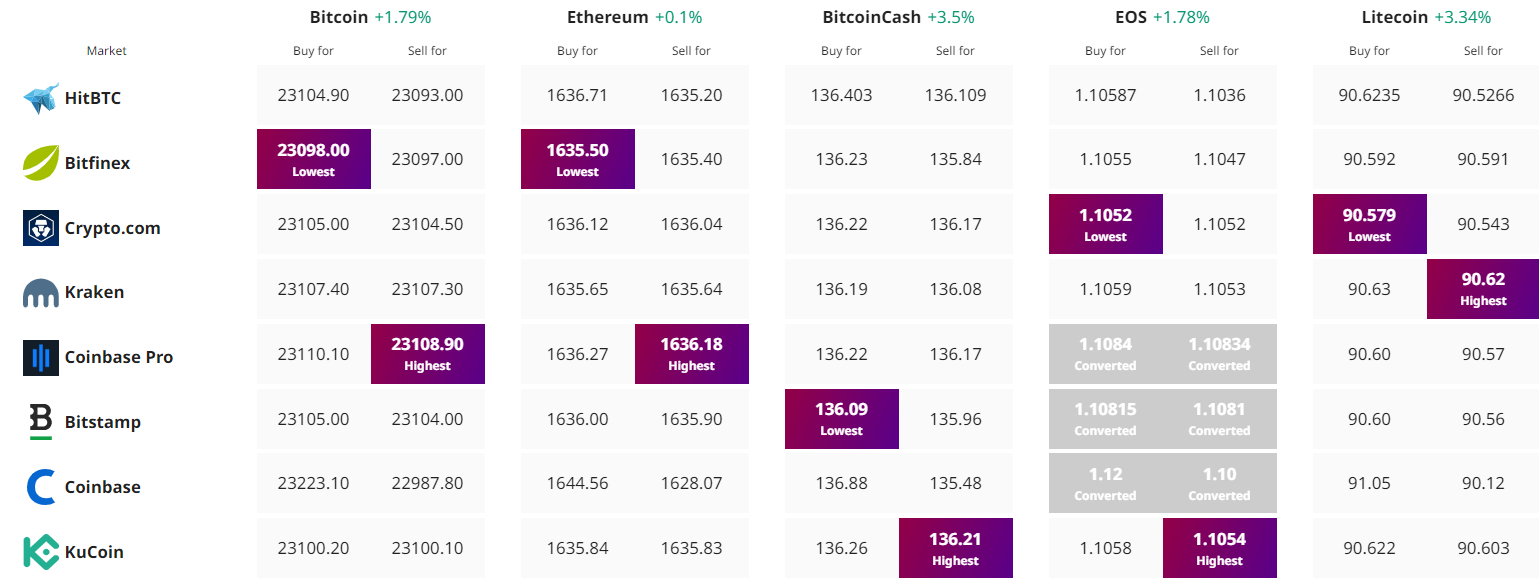

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com