[ad_1]

The merge of Ethereum (ETH), which is expected to complete the transition from the current proof-of-work (PoS) consensus mechanism to a proof-of-stake (PoS) framework, has been elusive for quite some time.

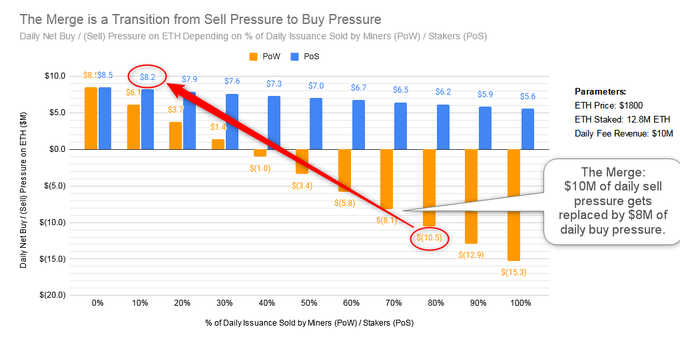

Nevertheless, a DeFi educator under the pseudonym Korpi believes it will be a game-changer because it will shift the selling pressure experienced in the Ethereum network, given that structural supply will change to structural buying. The educator explained:

“The Merge is a substantial change in supply or demand forces most people underestimate. Multiple Ms of daily sell pressure on ETH will be replaced by buy pressure. Every day we will need new sellers to prevent the price from going up.”

Source: Korpi

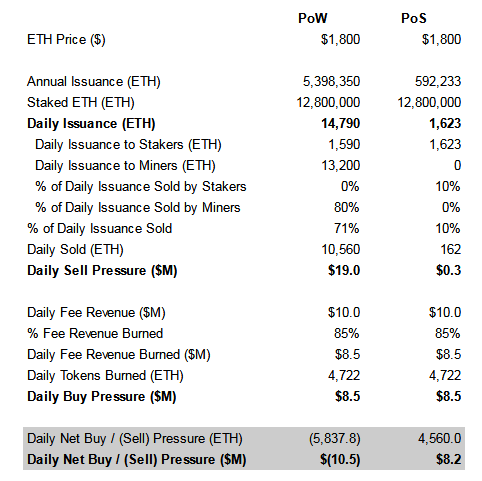

The DeFi educator also acknowledged that if the merge happened today, the $10 million of daily selling pressure witnessed in the Ethereum network would be changed to $8 million of buy pressure. Korpi added:

“Let’s confront structural supply and structural demand on a daily basis. PoW: Daily Sell Pressure: $19M Daily, Buy Pressure: $8.5M, Net: $10.5 of SELL PRESSURE every day. PoS: Daily Sell Pressure: $0.3M, Daily Buy Pressure: $8.5M, Net: $8.2M of BUY PRESSURE every day.”

Source: Korpi

Since the merge will bring both chains together, Korpi believes this will trigger a 90% issuance reduction, which will prompt a supply deficit. The educator noted:

“Every day ~13,200 ETH is issued to miners on PoW chain and ~1,590 ETH to stakers on PoS chain. ~14,790 new ETH daily corresponds to a 4.5% annual issuance rate. At the Merge block, both chains ‘merge’ into one, and the PoS era begins.”

Previously, analyses have shown that the merge will trigger a deflation rate in the ETH ecosystem based on slashed supply.

For instance, crypto service provider LuckyHash stated that a proof-of-stake consensus mechanism would prompt a 1% annual deflation rate, Blockchain.News reported.

Similar sentiments were shared by market analyst Lark Davis who opined that the merge would trigger a supply growth rate of -2.8% in the Ethereum network.

With Ethereum researcher Justin Drake recently disclosed that the merge is expected to work in August because testing was in the final stages, it remains to be seen how things shape up in the ETH ecosystem.

Image source: Shutterstock

[ad_2]

blockchain.news