[ad_1]

Bitcoin, the world’s leading cryptocurrency, has recently experienced strong performance, surging over 4% in just a few hours. Moreover, the performance of other digital currencies, like Ethereum, has also gained momentum. This indicates that the cryptocurrency market is growing in popularity and could continue to appreciate in value.

Even though the government has implemented stringent regulations on digital currencies, the cryptocurrency market continues to thrive.

Bitcoin, the most highly valued digital currency, is increasing in value, and numerous other forms of digital currency are emerging.

US GDP Figures in Highlights

In the world of cryptocurrencies, the prices of Bitcoin (BTC) and Ethereum (ETH) are known for their volatility, reacting to various global events and economic indicators. One such event that has the potential to impact their price movements is the release of the United States Final Gross Domestic Product (GDP) data.

As this key economic figure sheds light on the overall health of the US economy, traders and investors alike will be closely monitoring its effect on the cryptocurrency market.

At 12:30, the USD Final GDP q/q data will be released, and it’s likely to indicate that the US economy grew at a rate of 2.7% for the quarter, which matched the projected figure of 2.7%.

This data point, reflecting the overall economic health, could potentially impact the cryptocurrency market, particularly Bitcoin and Ethereum.

Bitcoin and Cryptocurrency Market Show Resilience Despite Regulatory Pressure

The global cryptocurrency market has been facing strict regulations from the US government, yet it continues to perform well. This is evidenced by the significant gains in Bitcoin, which has been gaining traction since the start of the year.

Additionally, several new types of digital currency have been introduced this year. Despite the government’s efforts to restrict it, these new digital currencies hold significant value, which is good news for Bitcoin holders as their value is expected to rise.

As of January 1, 2023, there were over 22,000 types of digital currency valued at almost $800 billion. By March 29, 2023, there were more than 23,000 types of digital currency valued at over $1.1 trillion. This indicates that, despite government intervention, the digital currency market is still growing.

It is worth noting that even in 2023, around 10 new types of digital currency are being introduced daily, despite the regulatory issues. Although the largest digital currency exchange, Binance, is facing legal issues, this has not deterred people from using digital currency.

Bitcoin Predicted to Drop to $13,000 Despite Recent Rally, Says Chief Market Strategist

Bitcoin (BTC) has had an impressive year, with a 70% increase and currently trading at around $28,400. However, Gareth Soloway of InTheMoneyStocks.com predicts that it will drop to under $13,000 before rebounding.

The financial industry has experienced difficulties, with institutions like Silvergate Bank and Signature Bank failing in the United States and Credit Suisse being acquired by UBS. Soloway suggests that the recent surge in Bitcoin is due to individuals investing in Bitcoin instead of traditional banks.

However, as the banking system stabilizes, Bitcoin’s value may decrease, and it could potentially drop as low as $9,000 in 2023. Therefore, while Bitcoin is currently performing well, its success may be short-lived, and its value may decline.

As a result, this bearish forecast is considered to be one of the primary factors that could constrain further growth in BTC prices.

Experts Predict Bright Future for Bitcoin with Potential Price Surge

On a positive note, Bitcoin’s future looks promising as experts anticipate a surge in its value. Balaji Srinivasan, a former director at Coinbase, has placed a $2 million bet that Bitcoin will be worth $1 million within 90 days.

Meanwhile, Marshall Beard, the Chief Strategy Officer of US cryptocurrency exchange Gemini, predicts that Bitcoin will reach $100,000 this year.

Analysts suggest that institutional investors’ increasing adoption of cryptocurrencies is one of the key factors that could drive up demand for Bitcoin, resulting in a significant price increase.

The optimistic predictions made by these experts are expected to contribute to the factors that could push up the price of BTC.

Bitcoin Price

The current Bitcoin price is $28,314, and the 24-hour trading volume is $20.7 billion. Bitcoin has increased by nearly 4% in the previous 24 hours.

According to technical analysis, the BTC/USD pair is currently exhibiting a positive trend. However, it may face obstacles once it reaches the $28,950 threshold.

If Bitcoin successfully surpasses the resistance level at $28,950, it could potentially push its value higher to $29,250 or even $30,500.

However, if a bearish trend emerges, there are expected to be support levels around $26,500 and $25,500 that could offer significant backing.

Buy BTC Now

Ethereum Price

The current price of Ethereum is $1,789.56, with a 24-hour trading volume of $9.2 billion. In the last 24 hours, Ethereum has gained about 0.50%. Currently, Ethereum is struggling to break through the resistance level of $1,840 and has been consistently trading near the $1,700 support zone.

If the ETH/USD pair manages to surpass the $1,800 level, it is expected to encounter resistance at the $1,900 mark.

It is anticipated that the ETH/USD pair will have support levels at either $1,700 or $1,620.

Buy ETH Now

Top 15 Cryptocurrencies to Watch in 2023

Stay up-to-date with the latest ICO projects and altcoins by regularly checking out the curated list of the 15 most promising cryptocurrencies to keep an eye on in 2023, recommended by experts at Industry Talk and Cryptonews.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

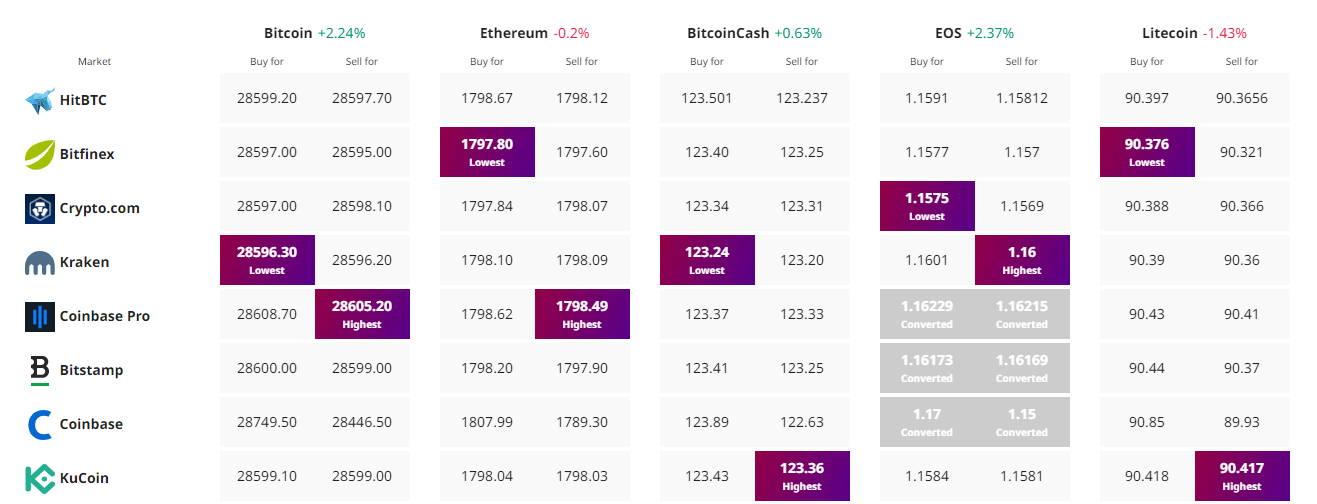

Find The Best Price to Buy/Sell Cryptocurrency

[ad_2]

cryptonews.com