[ad_1]

XRP, the cryptocurrency that powers the payments-focused decentralized XRP Ledger, a layer-1 blockchain, is the best-performing cryptocurrency in the top 20 by market capitalization on Wednesday.

According to CoinGecko, XRP is up over 8.5% in the last 24 hours.

XRP/USD is currently changing hands in the $0.53s per token, having pared back from ten-month highs hit earlier in the session in the $0.58s.

Ripple Lawsuit Win Optimism Bolsters XRP Price

XRP’s surge comes as optimism builds that fintech payments company Ripple, the cryptocurrency and XRP Ledger’s creator, will win an ongoing lawsuit against the US Securities and Exchange Commission (SEC).

Ripple has been battling the SEC in court after the agency sued Ripple back in December 2020, claiming the company issued XRP as an unregistered security.

Ripple has been arguing that it can’t have issued XRP as an unregistered security as XRP is actually a digital commodity, meaning its falls under the regulatory oversight of the Commodity Futures and Trading Commission (CFTC).

That argument seems to have gotten a boost this week, after the CFTC announced a new lawsuit against Binance for operating as an unregistered exchange in the US.

The key part of the lawsuit for XRP is the CFTC’s claim that Bitcoin, Ether, Litecoin, Tether and Binance USD are all commodities.

Traders are hoping that this means the CFTC will also view XRP as a commodity, undermining the SEC’s lawsuit against Ripple, and reducing the regulatory risk that has been capping XRP’s price.

XRP is Now Really Heating Up

Amid anticipation that Ripple will win its lawsuit versus the SEC, alongside a broader crypto market surge that has seen Bitcoin gain more than 70% this quarter, the XRP market is really heating up.

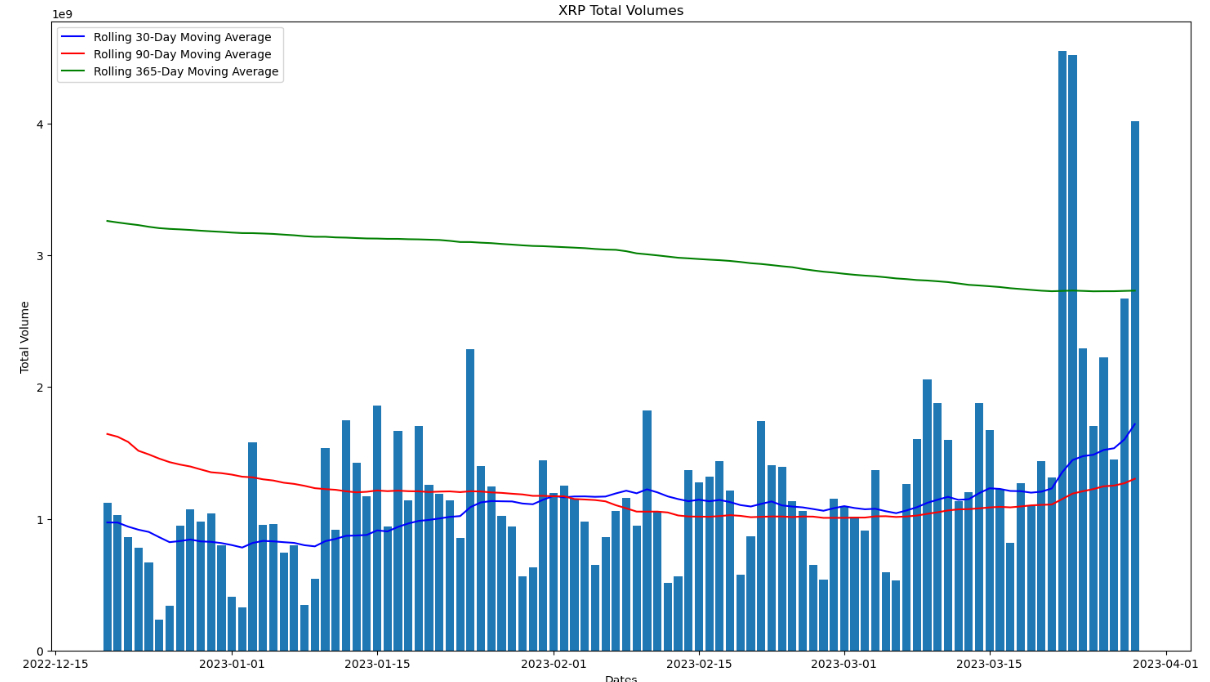

Futures open interest and trading volumes have also been surging. Daily XRP trading volumes surpassed $4 billion for the third time this month on Wednesday, rising well above the yearly moving average of around $3 billion.

That’s up substantially versus late-December levels of routinely under $1 billion in volume per day.

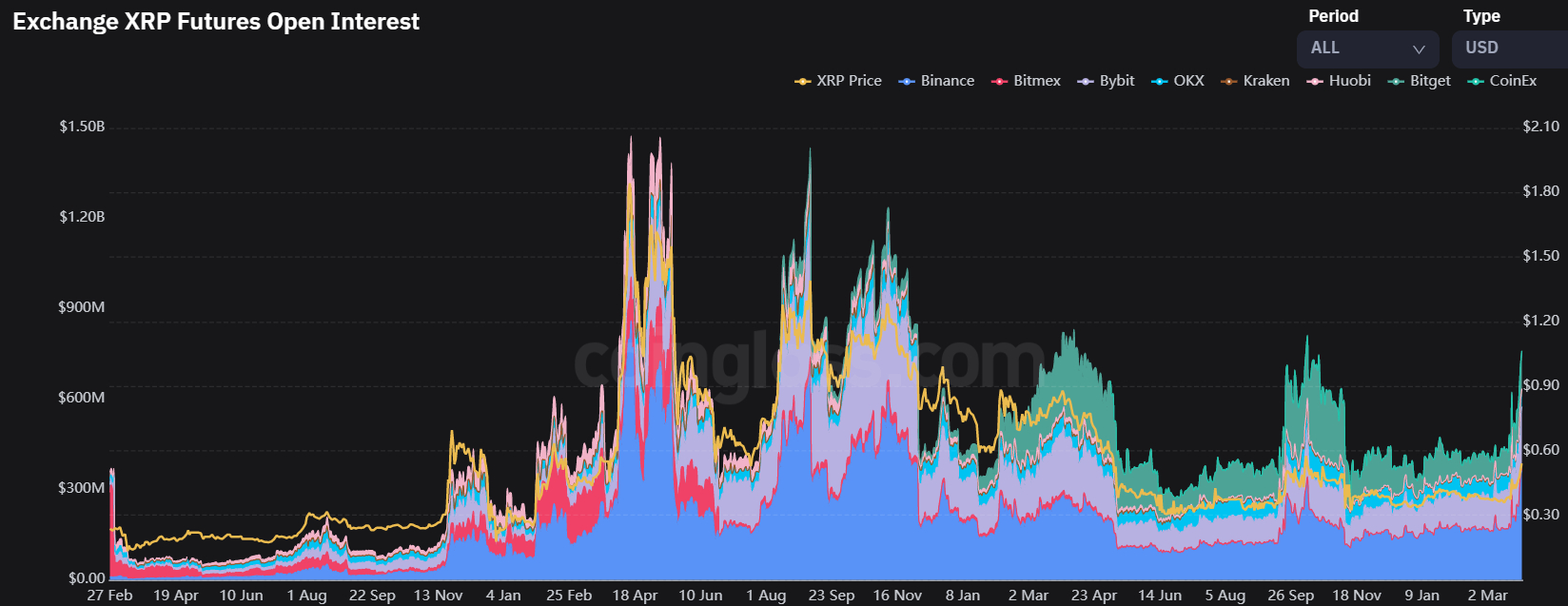

Open Interest, the total value of all open XRP-related futures positions across major exchanges, recently rallied above $750 million for the first time since last October, as per data from crypto derivatives analytics firm Coinglass.

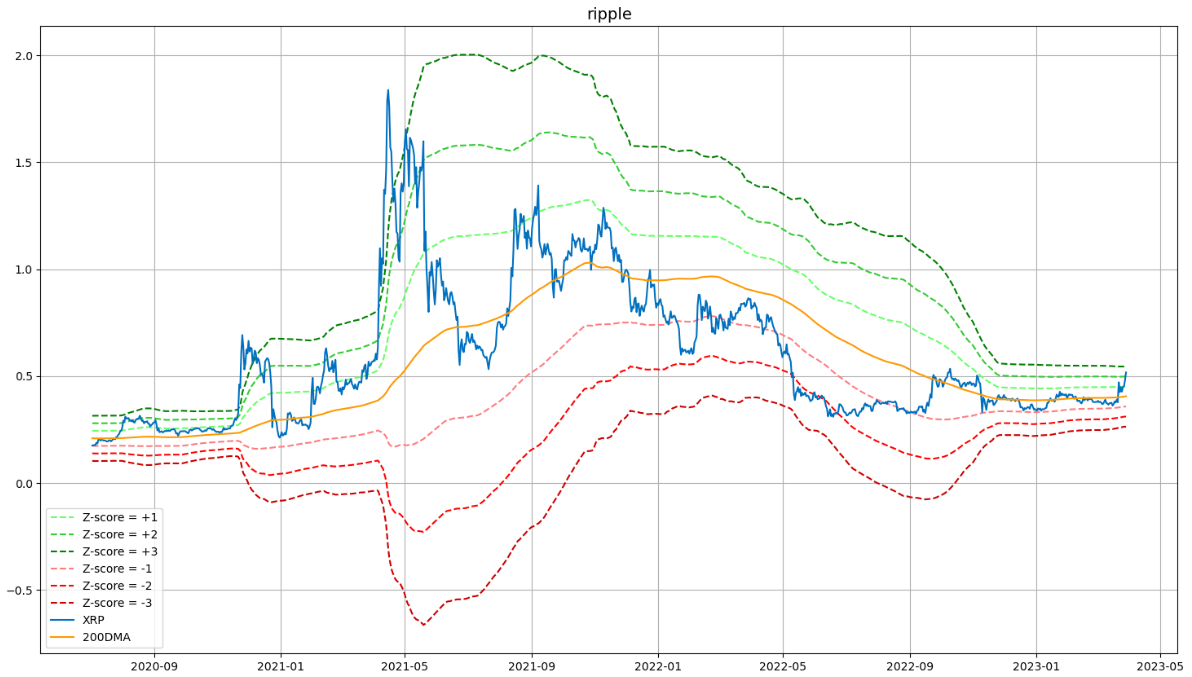

Meanwhile, the push higher in XRP’s price to the mid-$0.50s per token has seen the cryptocurrency’s Z-score versus its 200-Day Moving Average surpass 2.0 for the first time since early 2021.

A Z-score of above 2.0 means XRP’s current price is more than two standard deviations above its mean over the last 200 days (the 200DMA). Z-scores of 2 or above typically signify a hot market.

Price Prediction – $1 XRP Incoming?

Ever since breaking above the downtrend from the H2 2022 highs, XRP’s technical outlook has been good.

If XRP can close above the key long-term $0.55-56 resistance level, that would open the door to a rally to the next major resistance area around $0.90.

If XRP can take out this level, then a swift move above $1.0 would likely be next.

So long as the broader crypto market continues performing well and optimism that Ripple can win versus the SEC keeps building, there is no reason why XRP cannot continue its near-term positive momentum.

XRP’s 50DMA is likely to soon cross above its 200DMA (a so-called “golden cross”), which could further add to the tailwinds.

The fact that XRP’s 14-day Relative Strength Index (RSI) has entered overbought territory is a slight concern for the bulls, as it signals the risk of a profit-taking-driven pullback is likely.

But given positive longer-term tailwinds, expect XRP dips to continue being bought in the near future.

XRP Alternatives to Consider

XRP’s near-term outlook is looking very good. But crypto investors should always consider diversifying their portfolios to increase the prospect of generating returns.

A good way to do this might be to check out some high-potential crypto presales – historically, getting in on a project at the early presale stage has been the best way to generate a return in crypto.

In the list below, we’ve reviewed the top 15 cryptocurrencies for 2023, as analyzed by the Cryptonews Industry Talk team.

The list is updated weekly with new altcoins and ICO projects.

Disclaimer: The Industry Talk section features insights by crypto industry players and is not a part of the editorial content of Cryptonews.com.

[ad_2]

cryptonews.com